How will the airline industry recover?

Geoff van Klaveren, Vice President of Capgemini Invent, outlines three key steps that airlines can take to weather the storm of the COVID-19 pandemic

The coronavirus pandemic…

Geoff van Klaveren, Vice President of Capgemini Invent, outlines three key steps that airlines can take to weather the storm of the COVID-19 pandemic

The coronavirus pandemic has been the most financially devastating period in the history of aviation. Lockdowns and travel restrictions imposed in 2020, to try to limit the global spread of coronavirus, have hit the aviation sector hard.

But now, with a possible end to the pandemic in sight, the question is, has the industry been fatally damaged or will it re-emerge stronger? Finding a proportionate way to steadily resume the number of flights while minimising the risk of the spread of coronavirus remains a priority for the UK Government, like other governments across the world. We believe there are three key steps that airline management need to take to ensure their airline emerges as one of the winners and not one of the casualties of the pandemic.

1. Move to a more variable cost business

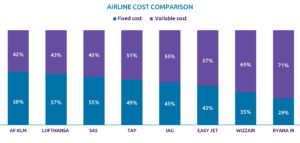

The majority of European network airlines went into the pandemic with a high proportion of their costs fixed ranging from 45 per cent for IAG to 58 per cent for Air France-KLM as shown by figure 1. These include employees, engineering and aircraft ownership costs that could not be reduced as fast as the decline in revenues. This meant that as the travel restrictions came in, airlines were immediately plunged into a very serious cash burn situation.

Figure 1: Airline cost comparison

Source: Annual reports 2019 (March 2020 for Ryanair & Wizzair, Sep 2019 for easyJet). Capgemini estimation of fixed versus variable costs.

In contrast, new generation carriers had much lower fixed costs, ranging from 29 per cent for Ryanair to 43 per cent for easyJet, which meant that cash burn was much lower. Ryanair even managed to turn a small profit in the summer quarter of 2020 (July-September). Airlines need to be ready for the possibility of another unprecedented situation and consider moving more of their costs to be variable, be through more flexible employment contracts or power-by-the hour aircraft engine maintenance for example.

Also, adapting a lean approach can help cut costs significantly while enhancing the experience of employees and customers by sharpening on-time performance, reducing wait times for guests, increasing the working availability of aircraft and ground assets.

2. Take an intelligent approach to reducing costs

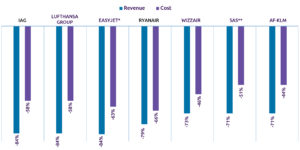

All airlines have had to make drastic reductions in their costs to survive as shown by figure 2 which shows the reduction in revenue and costs (year-on-year) in the period from April 2020 (when the lockdowns began) to December 2020 (the latest reporting period).  However, it is the manner in which costs have been reduced that will distinguish the winners from the losers, as the recovery kicks in.

However, it is the manner in which costs have been reduced that will distinguish the winners from the losers, as the recovery kicks in.

Did airlines temporarily cut costs or simply make an arbitrary 30 per cent employee efficiency saving across the board? Or can the latest in digital technologies, such as artificial intelligence (AI) and robotic process automation (RPA), help structurally reduce their cost base to build a better business for the future that can be scaled back up with improved productivity?

Figure 2: Revenue and cost change April-December 2020 versus prior year

Source: Interim reports. *easyJet is for H2 period April-September; **SAS is for nine months to October

3. Accelerate the customer digital journey

The pandemic has materially accelerated the growth in online sales and servicing, a trend which is here to stay even when physical shops reopen. The need for retailers to shift their sales online overnight in 2020 caused increased investment in their online capabilities and therefore customer expectations for a better experience and user journey are higher than they were before the pandemic. Even those who have a digital offer and their own app need to revisit it in light of ‘the Amazon experience’. Given this shift in user behaviour, airlines need to ask how well designed and easy to use their digital experience is, and critically how they can get better every day. The read-across for airlines is that their digital capabilities need to have kept pace with this consumer shift. Travellers will expect a more seamless and contactless journey. Smart phones will become even more important for the traveller dealing with all check-in processing including visa & vaccine checks, accessing live virtual customer service agents as well as accessing the inflight entertainment system touch-free. Authorities and airports may need to consider using the latest digital technologies to intelligently profile travellers from a security and health risk perspective to reduce pinch points on departure and arrival.

It is also safe to say that nimble travel companies will thrive as travellers look for offers driven by personalisation and flexibility. Offering flexibility may sound easy but this is a huge logistical challenge with enormous complexity for travel operators and their supply chains that can only be solved with data and technology to freely allow the sharing of data, enabled by real-time processing of information and transactions. To operate in an era of uncertainty where infinite flexibility in operational models is required, investments in open platforms, modern APIs, microservices and cloud technologies need to be prioritized.

Conclusion

The pandemic has accelerated much needed consolidation in the industry which will result in a more profitable industry when it recovers, enabling airlines to pay down their increased debt levels and continue to invest in new, more efficient aircraft.

The airlines that will emerge the strongest will be the ones that have been able to use 2020 to transform their cost base and plan for a future keeping any unprecedented situation in mind. They have not just temporarily reduced their cost base but made a structural change in the cost using technology so that their costs do not return to the same degree as operations scale back up again, while being prepared to adjust to unprecedented situations, if needed. They will also have accelerated their digital capabilities to give customers a seamless and (virtually) contactless journey.

Subscribe to the FINN weekly newsletter