This week’s long-haul flight schedule changes from Europe: What you need to know

January 17, 2026

Each week, Aerospace Global News takes a look at some of the long-haul route changes to and from Europe, all of which are subject to further adjustments. This is the 14th edition.

This week, Luxair announced its plan to launch flights to Abu Dhabi, attacking Etihad Airways which announced its new service to Luxembourg just last week. Initially, the Emirati carrier planned three weekly flights. It now appears this has increased to four-weekly.

Luxair’s new route will fly once-weekly with a Boeing 737 MAX, complementing the carrier’s existing twice-weekly flights to Dubai World Central.

Aer Lingus is expanding its Dublin to Cancún route which began last week, adding service from October 2026 for the duration of the winter period. It will maintain thrice-weekly services on an A330-300. It has also filed the removal long-haul service from Manchester, as already reported.

This week’s schedule changes

Using data from aviation analytics firm Cirium, the below is a non-exhaustive list of developments this week. For readability purposes, adjustments that extend to a large part or the entirety of the 2026 summer season have been listed as ‘S26’. For the 2026/2027 Winter season, this is listed as ‘W26’.

Long-haul is defined as flights over 3,000 miles, meaning not all Europe to non-Europe flights are included, but only those that meet the threshold.

The sample was selected based on relevance and market trends, and does not include smaller changes such as minor aircraft changes with a limited impact on capacity. As always, schedules are subject to change. And, as we have seen in previous editions, they do.

North Atlantic

- Aer Lingus maintains Cancún flights next winter, with three weekly services added from October 2026.

- Aer Lingus removes planned A321neo flights from schedules to Pittsburgh and Raleigh-Durham in November and December 2026. The routes are therefore considered summer seasonal.

- Aer Lingus removes all Manchester-originating services for Winter 2026.

South Atlantic

- Azul Linhas Aéreas withdraws planned increase on flights from Madrid to São Paulo flights, returning back from 5x to 3x weekly services for S26 as per last year.

Africa

- Neos introduces 1x weekly Bari to Zanzibar flights for S26 and suspends planned 1x weekly Prague to Zanzibar flights.

- Ethiopian Airlines reduces Geneva to Addis Ababa service from 6x to 4x weekly frequencies. It recently introduced a new route to Lyon, via Geneva, as reported in last week’s schedule update.

Middle East

- Etihad increases Luxembourg to Abu Dhabi flights from 3x to 4x weekly flights ahead of launch in W26.

- Luxair introduces 1x weekly Luxembourg to Abu Dhabi flights with a 737 MAX 8 from W26.

- Saudia introduces 3x weekly London Heathrow to Dammam flights for S26 as well, with a Boeing 787-9. It resumed this route in November 2025.

- Qatar Airways reduces Manchester to Doha flights from up to 25x weekly to 21 weekly but switches aircraft to 777-300ER and A350s instead of 787-9 and A350s (resulting in more seats overall).

Asia

- Air China increases Warsaw to Beijing from 4x weekly to daily from S26.

- Qanot Sharq suspends brand-new A321neo flight from London Gatwick to Tashkent from January until March 2026.

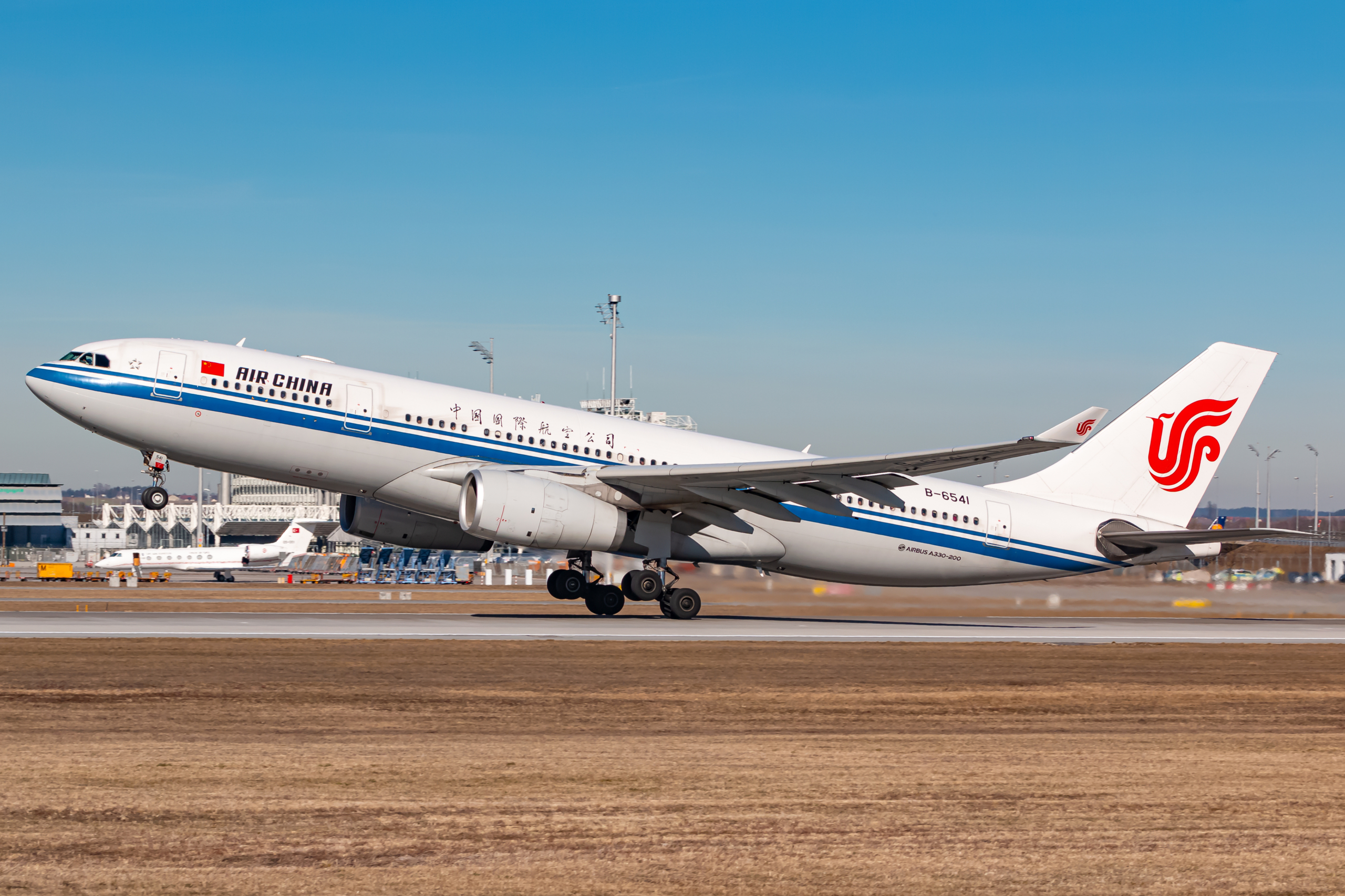

Air China expands Warsaw flights as part of broader European expansion in 2026

Air China has filed an increase to its services from Warsaw to Beijing. Initially filed as four weekly services, it has now increased this to daily. The route is currently operated by an Airbus A330-300 aircraft. LOT Polish Airlines no longer flies to China, having suspended service in late-2024 as European carriers pulled out citing intense competition and an inability to fly over Russian airspace as key challenges.

Air China’s increase means it will fly its highest-ever frequency on the sector. No individual airline has reached this amount of weekly frequencies on the service, though combined LOT and Air China once operated up to seven weekly flights.

Air China’s flights to Europe this year are up 6% according to Cirium, driven by increases on service to Warsaw, Paris, Budapest and Istanbul. It is also introducing two new routes, connecting Brussels with Beijing and Chengdu from S26.

| European destination | Growth in flights (2026 vs 2025) |

|---|---|

| Brussels | New |

| Warsaw | +50% |

| Istanbul | +30% |

| Budapest | +29% |

| Barcelona | +6% |

| Paris Charles de Gaulle | 3% |

Flights to Italy have reduced slightly as a result of the suspension of its Hangzhou to Rome flight and frequency reductions on flights from Wenzhou to Milan Malpensa.

Saudia’s rationalised service to London

Saudia is maintaining its resumed service between London Heathrow and Dammam in summer 2026. The service returned in November 2025 with a Boeing 787-9 after more than a decade. It suspended flights on the sector in October 2010.

The thrice-weekly connection will use slots already under Saudia’s control. It had relinquished three of its 14x weekly services from Jeddah to Heathrow to allow the Dammam flight to return.

Saudia is consolidating its London network to Heathrow this year. For summer 2026, it has suspended flights between London Gatwick and Jeddah that flew 4x weekly last year, and will also end 2x weekly flights from Neom Bay. This year, it will fly from London Heathrow to Jeddah, Riyadh and Dammam.

| Destination from London Heathrow | Weekly frequency (August 2026) | Aircraft |

|---|---|---|

| Dammam | 3x weekly | Boeing 787 |

| Jeddah | 11x weekly | Boeing 787 |

| Riyadh | 14x weekly | Boeing 777 |

Featured image: Lukas Wunderlich | stock.adobe.com